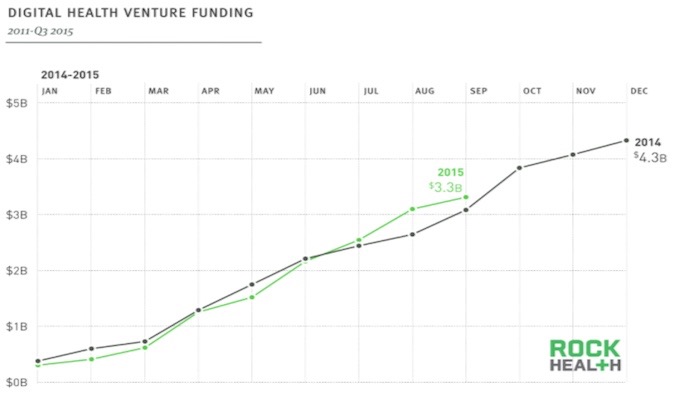

Venture funding of healthtech companies in 2015 to date is ahead of 2014 YoY: funding to date exceeds $3.3B

Key Trends

- Steady increase in mid stage (Series B and C) deals. Early stage deals hold strong with approx. 60% of volume

- Continued growth of Series A rounds will likely drive increasing follow-on rounds

- Increasing number of traditional tech VCs and corporate VCs investing in healthcare

- Genomics and diagnostics as categories represent a large portion of both early and late stage deals

Top 6 categories continue to account for more than 50% of all healthtech funding in 2015:

- Healthcare Consumer Engagement (Up from #4)

- Wearables & Biosensing (No change)

- Personal Health Tools / Genomics (New)

- Analytics & Big Data (Down from #2)

- Telemedicine (Down from #3)

- Payer Administration / Benefits (New)

Insurance also registered a couple of high profile funding rounds.

Steady state of Seed, Series A & B stage deals which continues to drive the vast majority of deal volume. Moderate increase in series C stage deals.

- 8 biggest deals represent more than 50% of Q3 transaction value

Noteworthy Asia deals in Q3 2015 – dominated by India and China:

- GuaHao – Series D – $394M – China

- Practo – Series B – $90M – India

- Portea Medical – Series B – $37.5M – India

- Lybrate – Series A – $10.2M – India

- Coverfox – Series B – $10.4M – India

Asia series A deal flow in healthtech is building reflecting maturing ventures with proven traction.

Q3 2015 YTD total M&A deals concluded stands at 146 – up from 90+ at the end of June 2015:

- 25+% of the target companies were acquired by companies outside of healthcare – up from 19% in 2014

Refer to The Propell Group’s weekly Healthcare Key Deals updates for further data on VC, PE, IPO and M&A type deals in this sector – Detailed Q3 deal trends and analysis to be published soon.

Overall, we are seeing 2015 funding flow edge ahead YoY, after a slow H1 2015, with seed and series A average deal size rising combined with later stage B and C rounds increasing their share of total venture funding.

Asia healthtech is witnessing a growth in the number and diversity of investors taking healthtech positions driven by a maturing deal flow and a greater understanding of healthcare dynamics in the region. We expect to see an increase in the number of series A and later rounds in the coming 6 to 12 months.

Source: Rock Health, Startup Health, Mercom Capital Group, The Propell Group

#healthtech #asia